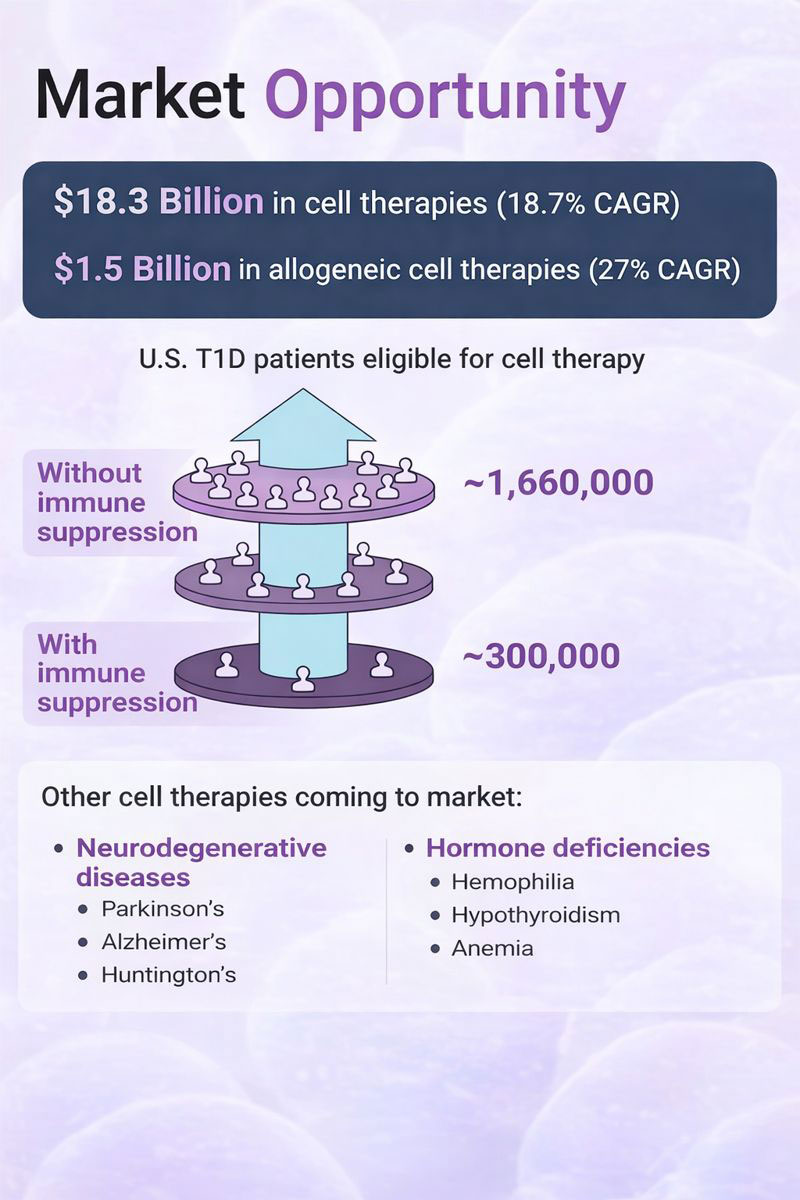

Explosive growth in cell therapy market with allogeneic therapies leading the charge

$18.3B

in cell therapies

18.7% CAGR

$1.5B

in allogeneic cell therapies

27% CAGR — Fastest growing segment

U.S. T1D Patients Eligible for Cell Therapy

Without immune suppression ~1,660,000 With immune suppression ~300,000

5.5x market expansion by eliminating immune suppression requirement

Other Cell Therapies Coming to Market

Neurodegenerative Diseases

- Parkinson’s

- Alzheimer’s

- Huntington’s

Hormone Deficiencies

- Hemophilia

- Hypothyroidism

- Anemia

ImmunoShield’s platform technology is disease-agnostic, positioning us to capture value across multiple high-growth therapeutic areas

Go-to-Market Strategy

Strategic path from technology development to market-ready product through pharma partnerships

-

1-2 High-Risk Technology

Early stage, uncertain future

-

Current Stage3-4 De-risk Technology

Non-dilutive funding and seed investors to complete independent pre-clinical studies

-

5-6 Pharma Partnership

Investment and co-development for a cell therapy product with ImmunoShield's platform to complete IND-enabling studies

-

7-8 Safety & Efficacy Trials

Partner company takes over manufacturing and advancement of co-developed product after IND submission, starts clinical trials, potential acquisition

-

9 Market Ready Product

FDA approved product ready to scale

-

Near-Term (12-18 months)

- Complete independent pre-clinical studies

- Validate automated encapsulation platform

- Secure pharma partnership for co-development

-

Mid-Term (18-36 months)

- Complete IND-enabling studies with partner

- Submit IND for first indication

- Establish manufacturing partnerships

-

Long-Term (3+ years)

- Initiate Phase I/II clinical trials

- Explore acquisition opportunities

- Expand platform to additional indications

Strategic Partnership Model

Our go-to-market strategy leverages pharma partnerships to accelerate development, reduce capital requirements, and maximize value through strategic acquisition

-

Lower Capital Need

Partner funds clinical development

-

Faster to Market

Leverage partner infrastructure

-

Higher Exit Value

Validated clinical data drives acquisition

Competitive Landscape

ImmunoShield's dual approach provides significant advantages over existing solutions

vs. Immunosuppressive Drugs

Current Standard of Care

- Severe side effects (infections, kidney damage, cancer risk)

- Excludes 80% of patient population

- Lifetime drug regimen required

- Significant ongoing costs

ImmunoShield Advantage

- No systemic immunosuppression needed

- Accessible to all patients

- One-time intervention

- Lower total cost of care

vs. Other Encapsulation Technologies

Existing Approaches

- Microencapsulation: difficult to retrieve, limited lifespan

- Traditional macrodevices: poor scalability

- Still vulnerable to indirect rejection

- Limited manufacturing throughput

ImmunoShield Advantage

- Retrievable spiral design

- Automated, scalable manufacturing

- Addresses both direct AND indirect rejection

- High-throughput production capability

vs. Gene Editing Approaches

Gene Editing Methods

- “Stealth cells” – complex manufacturing, uncertain longevity

- Higher regulatory hurdles

- Permanent genetic modifications

- Limited to specific cell types

ImmunoShield Advantage

- No genetic modification of therapeutic cells

- Clearer regulatory pathway

- Reversible intervention

- Platform applicable to any allogeneic cell type